Adani Group’s Financial Investigation Explained

The controversy surrounding Adani Group and its alleged financial misdeeds has attracted significant attention, not only in India but also globally. This article will break down the complex issues raised in the Hindenburg Research report and the subsequent responses from the Securities and Exchange Board of India (SEBI) into simpler terms to help a general audience understand the situation.

Background on the Adani Group Investigation

The Adani Group is one of India's largest conglomerates, with interests ranging from ports and power to infrastructure and green energy. However, in 2022, Hindenburg Research, a U.S.-based firm that specializes in short-selling, published a report alleging that the Adani Group engaged in financial misconduct. Hindenburg claimed that the company was involved in manipulating its stock prices and carrying out fraudulent transactions using offshore shell companies.

Hindenburg's report called the Adani Group's operations "the largest con in corporate history." The firm highlighted a network of offshore entities, primarily based in Mauritius, which were allegedly used to siphon billions of dollars through undisclosed and related party transactions. This is when two companies or individuals who have a relationship (e.g., a common owner) conduct business, often at unfair terms to benefit one party.

SEBI's Role

SEBI, India's securities market regulator, is tasked with overseeing financial markets and ensuring that companies follow the law. One of SEBI's key responsibilities is to protect investors by ensuring companies are transparent in their dealings. After Hindenburg’s report, SEBI was expected to investigate the allegations against Adani Group.

However, SEBI's response has been slow and, according to Hindenburg Research, somewhat lackluster. Despite more than 40 media investigations and numerous pieces of evidence corroborating Hindenburg’s claims, SEBI has not taken any significant public action against Adani Group. This inaction led to questions about SEBI's ability and willingness to regulate powerful corporations.

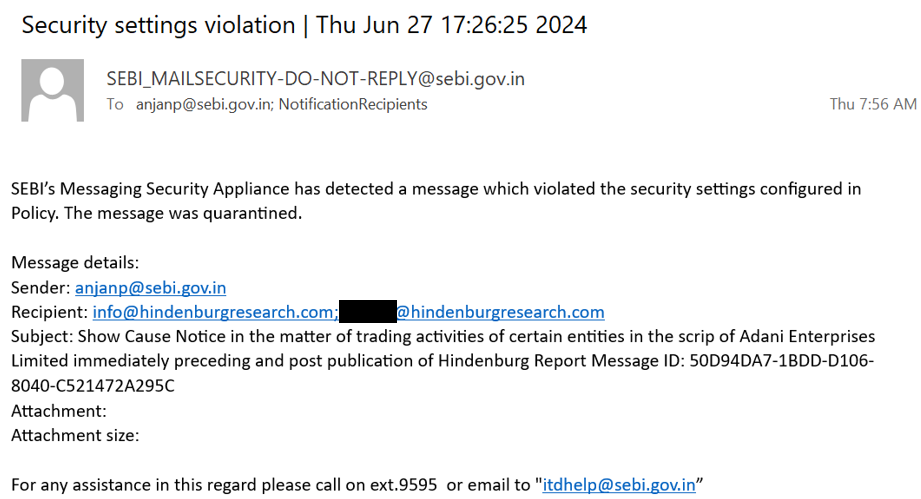

SEBI's Notice to Hindenburg Research

Instead of focusing entirely on the Adani Group, SEBI took an unexpected step in June 2024. The regulator issued a "show cause" notice to Hindenburg Research, accusing the firm of providing insufficient disclosure of its short position (a financial position that benefits when a company's stock price falls) against Adani. SEBI did not find any factual inaccuracies in Hindenburg’s report but claimed that their disclosure practices were not as robust as they should have been.

Hindenburg responded by pointing out that SEBI seemed more concerned with Hindenburg’s actions than with the alleged fraud at Adani Group, even though SEBI’s primary role is to prevent such financial misconduct.

Offshore Shell Companies: What Are They?

One of the key issues in the Hindenburg report revolves around offshore shell companies, particularly in Mauritius. For a general audience, it’s important to understand what these entities are and why they are controversial.

An offshore shell company is a business that exists only on paper. It doesn’t have active operations, but it can hold assets and conduct financial transactions. Shell companies are often set up in countries with favorable tax laws, like Mauritius, which is known as a tax haven.

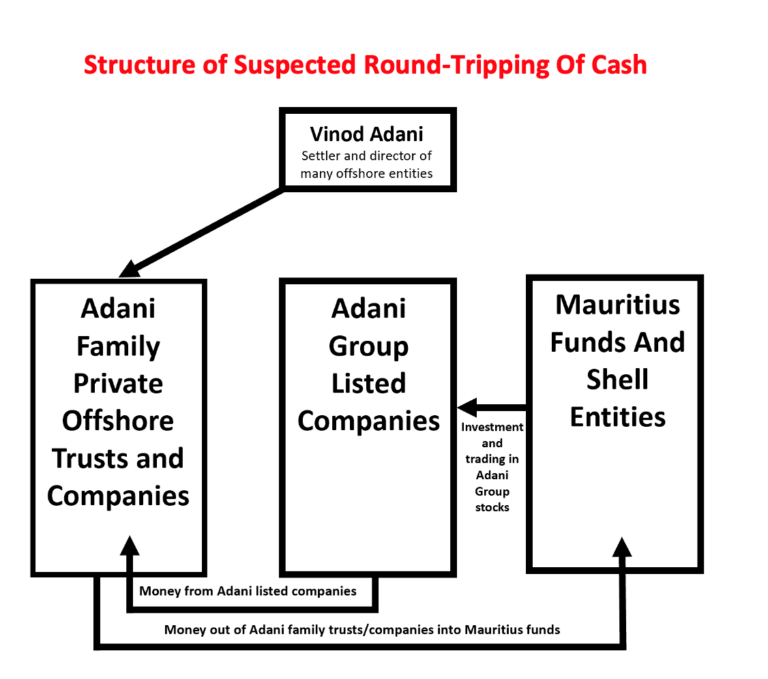

In this case, the offshore shell companies linked to Adani were allegedly used to carry out suspicious financial transactions. For example, Hindenburg's report suggested that Vinod Adani, the brother of Gautam Adani (the founder of Adani Group), used these offshore entities to funnel money back into Adani companies in India, artificially inflating the stock prices of Adani firms.

Stock Price Manipulation: How It Works

Stock price manipulation occurs when the price of a company’s stock is artificially inflated or deflated through fraudulent means. This can be done by creating a false appearance of demand or using related entities to buy shares and push up the price.

Hindenburg's report claims that Adani Group engaged in such manipulation by using its network of offshore companies to buy shares in its own companies. This would create the appearance that there was more demand for Adani’s stock than there actually was, thus driving up the price.

SEBI’s Struggles and Conflict of Interest Allegations

According to the Hindenburg report, SEBI struggled to make headway in its investigation. The Indian Supreme Court even noted in June 2024 that SEBI had "drawn a blank" in its investigation into Adani's offshore shareholders.

One major allegation raised by Hindenburg is that SEBI’s current Chairperson, Madhabi Buch, may have had a conflict of interest in the case. Documents from whistleblowers suggest that Madhabi Buch and her husband held stakes in some of the same offshore funds implicated in the Adani scandal. Specifically, they reportedly had investments in a Mauritius-based fund that was part of the structure used by Vinod Adani to manipulate stock prices.

Hindenburg argues that SEBI’s reluctance to take action against Adani Group could stem from this potential conflict of interest. If true, this would mean that SEBI’s top official was personally tied to the same offshore funds under investigation.

Key Allegations from Hindenburg

To summarize, Hindenburg’s key allegations against Adani Group include:

- Stock Price Manipulation: Using offshore shell companies to buy shares in Adani companies, inflating stock prices.

- Undisclosed Transactions: Failing to disclose related party transactions, which are supposed to be made transparent to shareholders and regulators.

- Offshore Shell Companies: Using these entities to launder money and carry out suspicious financial activities.

- Over-Invoicing: Adani Group allegedly inflated the value of imported equipment to siphon money abroad through shell companies.

What Does This Mean for Investors?

For individual investors, these allegations highlight the importance of transparency and accountability in financial markets. When companies engage in financial misconduct, it undermines investor trust and can lead to significant financial losses. If Adani Group’s stock price was artificially inflated, investors who bought shares at high prices could face losses when the price eventually corrects itself.

This case also serves as a reminder of the importance of strong regulatory bodies like SEBI. Investors rely on regulators to act as watchdogs, ensuring that companies play by the rules. If regulators fail to act or are compromised by conflicts of interest, it can put the entire financial system at risk.

Conclusion: The Importance of Transparency

The Adani Group case is a complex financial scandal involving allegations of stock manipulation, money laundering, and regulatory failure. For amateur investors and the general public, the key takeaway is the importance of transparency in financial markets. When companies are allowed to operate in secrecy and regulators fail to act, it can lead to large-scale financial misconduct.

The ongoing investigation into Adani Group will be crucial in determining whether these allegations are true and, if so, what consequences the company will face. At the same time, SEBI’s role in the case will be closely scrutinized to ensure that it is acting in the best interests of investors and upholding its mandate to prevent financial fraud.

This case highlights the need for vigilance among both regulators and investors to maintain the integrity of the financial system.